New data from the American Medical Association show that Arizona’s health insurance markets remain highly concentrated as of Jan. 1, 2024, with one or two insurers holding dominant market share across commercial, Medicare Advantage, and ACA exchange products.

In the commercial market, UnitedHealth Group holds the largest statewide market share, followed closely by Blue Cross Blue Shield of Arizona (BCBSAZ). Regionally, BCBSAZ leads in Flagstaff, Lake Havasu City, Kingman, Prescott Valley, Prescott, Sierra Vista, Douglas, and Yuma, often with a clear majority of enrollment. UnitedHealth Group leads commercial coverage in Phoenix-Mesa-Chandler and Tucson, with CVS Health’s Aetna unit playing a meaningful secondary role in several urban markets.

To assess how competitive each market is, the American Medical Association uses the Herfindahl-Hirschman Index (HHI), the standard measure applied by federal antitrust regulators. The index reflects how market share is distributed among insurers, with higher values indicating greater concentration and fewer meaningful competitors.

HHI thresholds

1,000–1,800: Moderately concentrated

Above 1,800: Highly concentrated

Table A-1. Market concentration (HHI) and largest insurers’ market shares

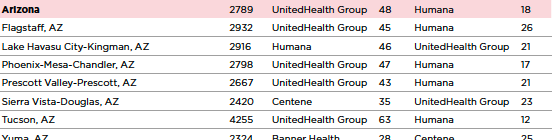

That pattern continues in Medicare Advantage, where UnitedHealth Group is Arizona’s leading carrier, followed by Humana. UnitedHealth Group leads MA enrollment in Phoenix-Mesa-Chandler, Prescott Valley, Prescott, and Tucson, while Humana leads in Lake Havasu City, Kingman. Centene holds the largest MA market share in Sierra Vista, Douglas, and Banner Health and Centene split the market lead in Yuma.

Table A-4. Market concentration (HHI) and largest insurers’ market shares, as of Jan. 1, 2024 Medicare Advantage markets

Exchange enrollment shows more variation, though concentration remains high. Aetna led the Arizona exchange market statewide in 2024 (Banner|Aetna exited the Marketplace in 2026), followed by UnitedHealth Group. Regionally, Aetna leads in Phoenix-Mesa-Chandler, Tucson, and Yuma, Blue Cross Blue Shield of Arizona dominates Prescott Valley, Prescott, and Centene leads in Flagstaff and Sierra Vista, Douglas.

Table A-3. Market concentration (HHI) and largest insurers’ market shares, as of July 1, 2024 Exchanges

![]()

PPO products remain among the most concentrated segments of Arizona’s commercial market. Blue Cross Blue Shield of Arizona leads statewide PPO enrollment, followed by Aetna, and holds commanding shares across most regions. Cigna is the lone exception, emerging as the leading PPO carrier in Phoenix-Mesa-Chandler.

Table A-2. Market concentration (HHI) and largest insurers’ market shares, as of Jan. 1, 2024 PPO product markets

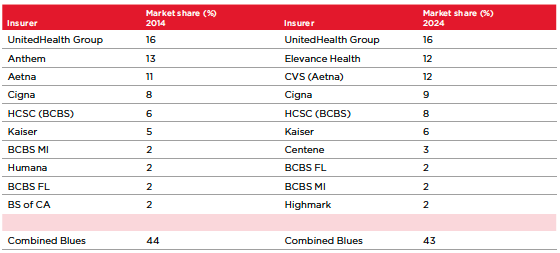

Nationally, the AMA found that 97% of commercial markets and 97% of Medicare Advantage markets are highly concentrated, with nearly half of commercial markets dominated by a single insurer controlling at least half of enrollment. While Medicare Advantage concentration has moderated slightly and exchange competition has helped temper consolidation in commercial coverage, the AMA said competition remains limited in most markets.

According to the AMA analysis, more than half (52%) of markets that were already highly concentrated in 2014 became even more concentrated by 2024.

Table 4 Largest health insurers in the U.S. at the national level 2014 – 2025

CEO and EVP of the American Medical Association John J. Whyte, MD,

These trends, paired with outside evidence of anticompetitive behavior, strongly suggest that market power is being exercised in ways that can harm patients and the physicians who care for them.

The newest edition of the AMA’s Competition in Health Insurance: A Comprehensive Study of U.S. Markets (PDF) analyzes 2024 data across 384 metropolitan areas, all 50 states, and the District of Columbia.

Leave a Reply

You must be logged in to post a comment.